On June 1, 2016 at the Sohn Hong Kong conference, we laid out our short thesis for Tech Pro Technologies (03823.HK). Our presentation included the following points:

- Our on the ground findings were that the company appears to have far less manufacturing staff and facility space than its public information indicates

- The recent purchase of a second tier French football club will be an investment that requires capital infusions

- The company is using equity financing to sustain its operations

Today, Tech Pro issued their rebuttal to our thesis. You can read the entire rebuttal here.

We wanted to dispute key findings raised in the rebuttal.

- Tech Pro Technologies did not dispute GeoInvesting due diligence that worker headcount and facility size at its LED manufacturing subsidiaries have been reduced dramatically.

- Tech Pro cites “outsourcing” LED production for the first time as an excuse for downsizing its LED manufacturing.

- The company admitted in its press release today to “out-of-date” and “no longer accurate” information regarding its facilities and staff on its website for at least the last 5 years.

- The company claims that its French football investment doesn’t need new capital despite independent media sources claiming the company is ready to invest up to Euro 100 million.

- We continue to believe the company needs to raise cash in order to fund its operations.

1. Tech Pro Technologies Downsizing the LED Business

In our original presentation, we pointed out that our on the ground interviews confirmed to us that the company’s LED business appeared to be downsizing, despite a lack of disclosure surrounding anything to do with downsizing. In today’s rebuttal, Tech Pro did not dispute the basic fact that it downsized its manufacturing facilities and decreased its manufacturing headcounts in its listed four manufacturing subsidiaries in China.

The company also convolutes the issue by mentioning additional parts of the business, like operations, which are based in locations such as Spain, France and Hong Kong. Our sole allegation from the beginning was thatmanufacturing facilities and staffing appear to have been downsized, according to our on the ground interviews.

Tech Pro confirmed our findings today, when they stated:

As benefited from the synergistic effect and economies of scale of those subsidiaries in the development of the LED business, the Group had been able to streamline its work force and consolidate the production facilities which were carrying out overlapping functions, when at the same time managed to maintain the level of operation and productivities.

……

For instance, the Group has outsourced the production process of certain products of the Group to other third party manufacturers, so that the Group is allowed to achieve a headcount reduction, shift the risks of costs increment to the manufacturers and reallocate its resources in a more effective manner.

While we appreciate the company lending color to this “streamlining”, the company didn’t mention downsizing, reducing headcount or even “streamlining” in its annual report. We also searched the company’s public disclosures on the Hong Kong Stock Exchange database for such claims, but were unable to find anything that would support the company’s newly disclosed information. In its annual report, Tech Pro made the following disclosure:

(ii.) the costs of production were kept on rising such as the labour cost, utilities cost; and

(iii.) the increased costs of production and operation cannot be shifted to the customers.

(page 18, 2015 Annual Report)

(ii.) the cost of production was kept on rising such as the labour cost, utilities cost; and the increased costs of production cannot shift to the customers.

(page 12, 2014 Annual Report)

This disclosure doesn’t mention anything having to do with reduction of headcount or layoffs in order to outsource LED production to third party manufacturers.

In the event that Tech Pro is actually outsourcing its LED production, we urge the company to revise its disclosure regarding its LED production to answer the following questions:

- Who are the third party manufacturers for Tech Pro’s LED production?

- When did these third party manufacturers start their work for the company?

- What LED products do these third party manufacturers produce?

- What’s the in house manufacturing production volume, compared to outsourcing production volume?

Further, the company goes on to admit that information contained on its website is at least 5 years old, and was “no longer accurate”:

“The Board believes that the figures described in the Report as the figures claimed by the Company regarding the number of employees of the Group and the gross floor area of the production facilities of the Group, were actually extracted from certain historical data contained in the website of the Company, which has been out-of-date and is no longer accurate.”

As of today, the website has removed the information about employee count and facility square footage. The removal of this information certainly doesn’t add clarity to the situation on a go-forward basis and makes due diligence far more difficult.

2. FCSM’S Business Performance

In the company’s June 7, 2016 press release, Tech Pro made the following carefully qualified statements about its French football club:

“In view of the financial resources presently available to FCSM and the performance of FCSM, the Board considers it is not necessary for the Company to inject any substantial investment to FCSM in order to support its operation for the time being.”

However, our analysis shows us that from July 2015 to December 2015, FCSM lost around USD/Euro 6 million. FCSM lost Euro 3.4 million in 2013 and Euro 13.2 million in 2014. Our evidence, including one source citing a French magazine article and one quote from management, supports our claim that the company is considering a sizeable investment in its football club:

- This French magazine article quotes “l’Equipe” magazine on 13/01/16 in stating that the company is considering the “incredible” sum of 100 million Euro as an investment.

- Further, this quote can be attributed directly to management: “Today, we have the fifth lowest budget in L2. If necessary, we are ready to invest 10, 20 or 100 million euros, but what interests me is how we will invest. We need to know if we will have guarantees,” he said.http://en.ytsports.cn/news-2056.html

The company states they’ll make an investment “if necessary” – but it seems to us that it’s going to be very necessary.

If the company doesn’t invest in its French football club or improve its cash burn, we will continue to expect it to perform poorly in the future. Potential relegation in future seasons for the company’s football club can lead to further devaluation of the club as a whole, and we simply don’t believe the company can support this portion of its business without raising capital going forward.

3. Financing Operations Moving Forward

Finally, the company claims that it doesn’t need to rely on financing to fund operations, when we’ve found that this simply isn’t the case. The company states, in its rebuttal:

“The Directors would also like to point out that no equity fund-raising activity for cash has been conducted by the Company since June 2014.

……

the Board is of the view that the Group currently has sufficient resources to finance its operations without having to resort to any debt or equity fund-raising activities.”

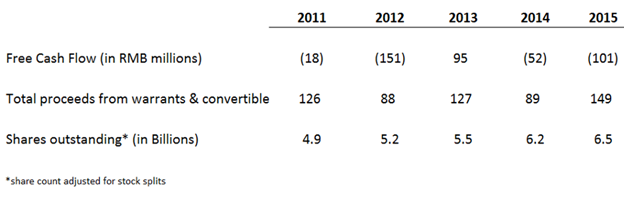

While it is nice of the company to point out that it hasn’t resorted to an equity financing since 2014, we never claimed the company performed a financing in 2015. We did, however, point out that the company received cash inflows of RMB ~149 million in 2015 from a prior financing. A quick look at the company’s cash flow figures from our conference slides shows clearly that the company has been reliant on the proceeds of equity (stock & warrants) financing to operate its business, while its share count has steadily increased.

In addition, days after our presentation on June 3, 2016, Tech Pro announced its intention to issue shares to acquire 50% of the Shanghai Target Company for a consideration of RMB 387.45 million. They proposed undertaking this transaction with a stock issuance at an issue price of HK$ 2.50 in six equal installments over six years after completion. We continue to believe the company is using cash raised to fund its operations and the company issuing shares to make acquisitions shows us that it is using shares as its currency.

Conclusion on Tech Pro Technologies

One can continue to believe the company and the narrative that the financials are fine or, as we do, one can believe that the company’s history of raising cash and management’s inability to make a profit will be indicative of its future plans to support the business. Since making its LED acquisitions in 2011, the company, in our opinion, has failed to build value within this segment.

We appreciate Tech Pro confirming our due diligence findings that the company lowered manufacturing employee head count and downsized its manufacturing facilities. We have to ask whether or not this would have ever been disclosed had our report not forced the issue with the company. We continue to believe the company needs to take on equity or debt financing to fund its operations moving forward.