One of key strategies I use to find microcap diamonds in the rough is to combine the concepts of Growth + Value. On April 11, 2016, I presented (videos at bottom) at the 2016 Microcap Conference Toronto, where I gave a speech on this very subject, some of which is paraphrased and elaborated on below.

—

I am co-founder of GeoInvesting, LLC and have been a Growth + Value investor since the late 80s, and a full-time investor since 1994. You probably already know that microcaps can give you outsized returns, but that the research avenues for the microcap investor are not as readily available or accurate when compared to larger capitalized stocks. Geo was launched in 2007/08 to bring institutional grade microcap research to a broader audience. We also help institutional investors/firms with their in-house research and on the ground due diligence needs, especially in China. We plan to launch a new product to help microcap investors perform more efficient earnings press release and SEC filing research.

Microcap Investor Attrition

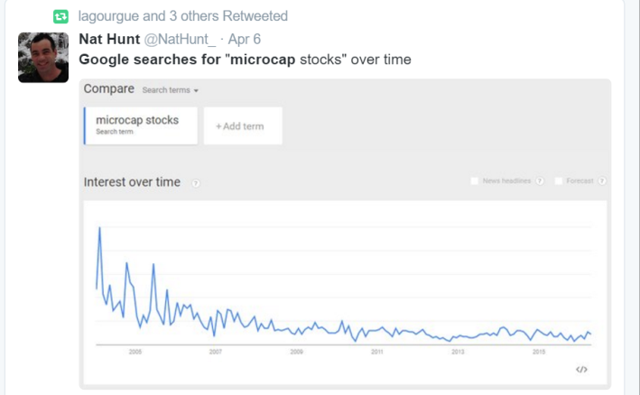

I didn’t anticipate the amount of microcap investor attrition the global recession would ultimately lead to. It is somewhat tough to statistically map out some of the carnage that has occurred in the microcap space but from the viewpoint of someone who has invested in microcaps for nearly 30 years, I can tell you that it has taken much longer for the market to recognize value through increased share prices in typical Growth + Value microcap opportunities. But the following tweet I came across illustrates that interest in microcap investing has been waning, even pre-2008:

Going forward, investors might want to check a new and much needed microcap index put together by LDmicro.com to get the most accurate representation of the microcap space over other so-called microcap “indices”.

Institutions, brokers and retail investors have clearly abandoned microcaps. In my opinion, the returns investors have been able to achieve in big caps and speculative areas of the market like biotechs have basically pushed traditional Growth + Value microcap propositions, especially in the microcap space, further from the perimeter. There is only so much capital to go around. Basically two dynamics have been in play since 2008:

- Investors don’t want to deal with the perceived risk inherent in microcaps, so they take less risk in big caps.

- Investors don’t want to hold stocks long term so they ironically look for grossly speculative plays to make big money fast.

I think this has really impacted the speed at which really cheap Growth + Value propositions rise to fair value and how long they hang onto price gains. It’s pretty amazing at how long it takes some microcaps to experience large positive moves and how fast they disappear.

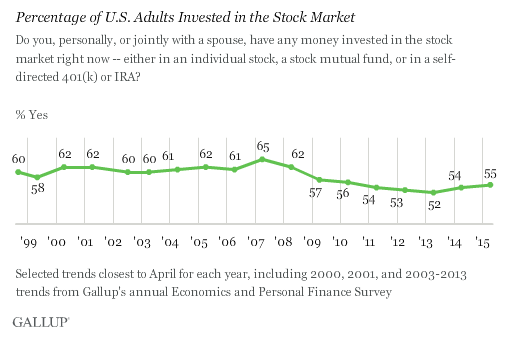

While overall investor participation in the stock market has been fairly constant,

- Fifty-five percent of Americans are invested in the stock market compared to sixty-two before the 2008 financial crisis. (Source: http://www.gallup.com/)

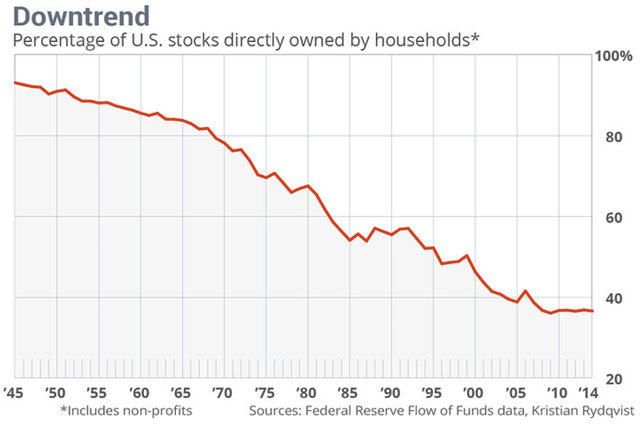

…the microcap investor attrition is disturbing when you consider that investors in general are moving to more pooled alternatives

- Pre-2008 the retail investor accounted for 2/3 of trading volume. Now program trading accounts for 2/3 of trading volume. (Sources: https://en.wikipedia.org, http://etfreference.com/

Still, if you are a Growth + Value investor, know that you are in good company and not alone in your suffering. 2015 was one of Warren Buffet’s worst years in his history. Here are some excerpts from a CNN Money article in December 2015 discussing Mr. Buffett’s year:

- “It’s been a tough year for most investors – including the most legendary one out there.”

- “Warren Buffett’s Berkshire Hathaway is on track for its worst year since 2008.”

- “This year, Buffett is lagging the market.”

- “The last time that Berkshire had a down year and underperformed the S&P 500 was all the way back in 1999. That year, the S&P 500 gained 19.5% while Berkshire’s A shares fell 20% and the B shares were down 22%.”

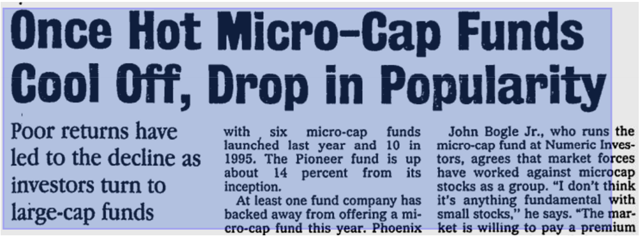

I found that last bullet point to be interesting. The year 1999 was a time when investors were in the tulip-mania phase fueled by the dotcom bubble. Investors put their capital to work into highly speculative bets. Investing styles come and go in cycles. I came across a 1997 Wall Street Journal article basically questioning the survival of microcap funds.

After the bubble did eventually burst, a Growth + Value microcap focus became very rewarding. I think this is similar to a scenario we have kind of been in during the current 7-year bull. Some of the speculative and even safer big cap names have started to break down.

So I believe the negative trends we have seen opens up the door to pick up cheap stocks and benefit from a Growth + Value strategy in preparation for when microcap investing will be in vogue again.

Growth + Value in Microcap Investing

This all leads into a topic I want to discuss. I want to talk about the Growth + Value investing concept, because I think it’s one of the most powerful and simple concepts in investing and potentially very rewarding for microcap investors, especially these days due to lack of investor interest in microcaps.

Here is how Investopedia tries to educate investors on the distinction between vale and growth investing:

- Value investors are strictly concerned with the here and now; they look for stocks that, at this moment, are trading for less than their apparent worth

- Growth investors, on the other hand, focus on the future potential of a company, with much less emphasis on its present price

From this definition, some could perceive a “growth” investor to have little regard for value and a value investor to put little emphasis on the future growth of a company; when in reality, investors just have different perspectives on what is cheap.

A key distinction that often emerges from the value vs. growth debate is that the value investor is perceived to only invest in boring beaten up stocks just looking at the breakup value of a company and that the growth investor is buying in vogue speculative companies with huge growth rates where prices will grow into their valuation. But sexy “growth” stocks can have tremendous value if found at the right time and boring companies can experience extraordinary sales and earnings growth. Another misconception is that value investors only buy stocks hitting lows and growth investors are only momentum hunters. The absolute price of the stock does not define its value. Value can be found at the end of either spectrum.

If you subtly combine these concepts you have a beautiful scenario – one where a stock is undervalued by your standards based on what is going on today, but is being grossly mispriced because of what you think is going to happen in the future.

The financial markets are full of concepts that sometimes make little sense to me. The growth or value argument is a case and point. When an investor asks me if I am a growth or value investor, I answer… “what do you mean? I look for both, obviously! I am looking for companies that will grow that are cheap. Growth and Value live together.” To quote Warren Buffett:

“Market commentators and investment managers who glibly refer to ‘growth’ and ‘value’ styles as contrasting approaches to investment are displaying their ignorance, not their sophistication…”

Personally I think all fundamental investors are value investors to some degree. What differentiates us are the catalysts we search for that will cause share prices to increase, our time horizons and preferred measures of fair value.

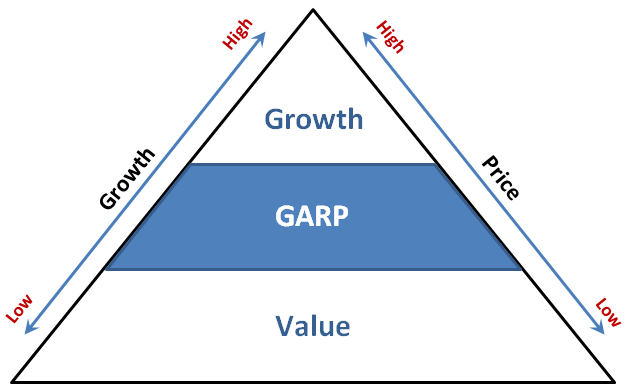

GARP

Growth at a reasonable price (GARP) is a common theme among Growth + Value seekers. Peter Lynch, Mario Gabelli, David Dremen were GARP investors. I look at a GARP as just a type of Growth + Value strategy.

“The GARP strategy incorporates philosophies of both growth and value investing, seeking a balance between companies that have had consistently strong earnings growth and those trading at attractive price valuations. The strategy’s main objective is to circumvent the extremities of either growth or value investing by selecting stocks that have both low relative PE ratios and high EPS growth rates.”

Source: Investopedia

Finding the Right GARP strategy

Here is a look at Peter Lynch’s strategy

Peter Lynch

- Trailing P/E<25

- Forward P/E<15

- Debt Ratio <35%

- EPS Growth >15% to <30%

- PEG Ratio (PE/EPS Growth Rate) <1.2

- Market Cap < $5 billion

In the most literal sense a true GARPer is looking for companies with growth rates that can be sustained with healthy balance sheets. He/she wants growth but not at such a high level where expectations can be missed, avoiding stocks where P/E’s are too low, an indicator of hidden risk factors. For example, a stock with a P/E that is too low or a dividend yield that is abnormally high could signify a high amount of unforeseen risks. But we all have our own versions of how to derive valuation scenarios.

At my youngest and most ignorant, I eventually decided that buying stocks at new 52-week highs would be the answer to all my problems. “If a stock is hitting highs, it has to be good,” I thought to myself. Therefore, I created a list of stocks trading at new highs over a several week span and tracked their performance. For comparative performances, I also created a list of stocks hitting new lows. Market conditions were normal and I quickly realized that returns were dismal for each method and were not that different from one another. Ending just as quick was the notion that I would be able to sit back and collect cash without some hard work. I then combined intensive research with some of Peter Lynch’s valuation rules to work to find momentum stocks where significant value existed. I did this with incredible success for years. We are trained to believe that this not a value strategy, but this exercise produced countless number of multi-baggers. These days I look for growth and value using several different methods.

In general, I try to approach investing in a manner where I want to find not so obvious mispricing. So unlike some Growth + Value investors, I am not as concerned so much with past EPS growth rates or current profitability. I am looking for catalysts for the growth and risk profile that will change the perception of what a “reasonable” price should be.

- Catalysts

- Reduced Leverage

- Margin Expansion

- Finding New Revenue For A Mature Legacy Product

- Acquisitions

- Reduced Customer Concentration

- New Management

My Microcap Mispricing Scenarios

I define my preferred mispricing scenarios into three categories.

1. Boring, Out of Favor

The first category is that of a profitable company being priced as a boring “out of favor stock” that is about to receive an expansion in its valuation multiples due to certain catalysts leading to a period of sustained EPS growth. Some of the best ideas that I have been able to participate in are stocks that are being priced as boring out of favor stocks that are about to enter an above average rate EPS growth cycle. It’s a plus If they pay fat dividends.

Educational Development Corp (NASDAQ:EDUC)

- 2015 GeoInvesting selection

- Unexciting publisher of children books

- Turned into a multi-bagger in just 13 weeks after we brought the stock to our members

- Fat divided before investors recognized catalyst

- Finding new revenue source for a mature legacy product

- Strong sales and EPS growth

BG Staffing Inc. (AMEX:BGSF)

- 2015 GeoInvesting selection

- Hot information technology staffing player

- Stock up 17%, near its 52 week high of $16.25.

- Growth through acquisitions

- Investors are slowly beginning to price in the potential EPS accretive related to acquisitions.

- Still has a fat dividend

- Pro-forma financial statement analysis taking acquisitions into account were buried in 8-K filings.

2. Catalysts and Return to Profitability

On the surface, some stock appear to be overpriced due to losses or meager profitability that is being ignored by investors, but is about to experience profitable growth or a return to profitability due to certain catalysts, leading to a period of sustained EPS growth:

Orchids Paper Products Company (AMEX:TIS)

- 2009 selection

- Manufactures branded and private label paper products

- One of the first stocks we loaded our portfolios with coming out of the Great Recession

- Stock increased 135% in one year from February 2009 to February 2010.

- Improving efficiency

- Utilizing more capacity

Evan Sutherland (OOTC:ESCC)

- 2014 selection

- Equipment and software for full-dome digital theater and planetarium system

- Boring industry

- Stock was losing money because of a past due pension liability

- We concluded that this issue would be resolved sooner, rather than later

- Issue was resolved and company became solidly profitable

- Stock increased 600% at current levels of near $1.00

Pioneer Power Solutions Inc. (NASDAQ:PPSI)

- 2016 selection

- Project management/services to power transmission markets

- Great industry outlook for next 5 years due to mandated upgrades to the power grid

- An August 2015 acquisition that took time to integrate and a recent equity offering depressed shares

- Shares look overvalued on trailing EPS but undervalued on what the company could do over the next couple years.

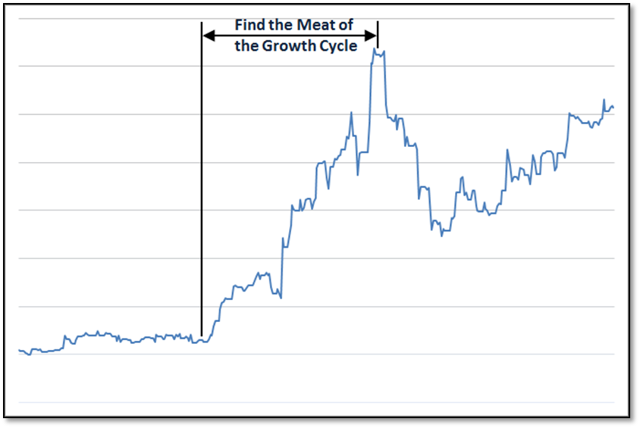

The key to these two scenarios is that they tend to take investors by surprise when a positive catalyst tales place, paving the way for multi-bagger moves since the mispricing can be severe. These plays are interesting for investors with shorter time horizons. Basically, you are trying to catch the mispricing right before the meat of a new growth cycle to capture out sized returns.

3. Severly Underpriced but Ignored

Some stocks are severely underpriced on current and future EPS but for some reason ignored. This scenario contains the best of both worlds and is why I like microcap investing. It’s much harder for these propositions to hide out in bigger capitalized stocks where institutions are playing.

—

Microcaps and GARP

We all know how quickly things can turn to the upside. When money pours back into microcaps, it can lead to outsized gains, just as cash outflows can sometimes lead to outsized losses. Here is how I sum up the last few years in the stock market. Reversion to the mean is sometimes painful, yet necessary:

“Market reversion is painful at first, but should lead to a scenario where active management and stock picking become important again. Over the last several years value had taken a back seat to hype leading to an overvaluation of ‘story stocks’ and ridiculous undervaluation of ‘boring’ stocks. At some point value will matter again.”

Sticking with a plan of finding undervalued companies in great financial shape with large earnings growth is the strategy I used in 2008 to pull myself out of a crisis with systemic risk, and I think this is the right strategy for 2016. In a nutshell, there is no better time to employ a Growth + Value strategy than when others are sleeping. It’s how multi-baggers are born.

Critics of GARP/PEG ratio

I will end this discussion with a word on the PEG ratio. David Einhorn has been openly critical of Peter Lynch’s PEG ratio. I think many investors have taken Peter Lynch’s concept out of context. For example, there will be investors that use his PEG ratio to justify buying a low PEG stock with a P/E of say 50. This may not be in all cases, but Mr. Lynch would have eliminated many of these stocks from his investment pool. He was very strict with not overreaching for unsustainable growth and looking for stocks with P/E’s between 15 and 25. He might look at this scenario if the company was cyclical in a scenario where EPS was about to explode.

—

Maj Soueidan at the 2016 Microcap Conference Toronto Part 1

—