Summary

- The most current SAIC records show Chairman and CEO Zhiwei Zhao suddenly resigned from his positions at three key Chinese VIE subsidiaries of JRJC over the past few months.

- This development has yet to be disclosed by management. Additionally, Zhao was also mysteriously absent from JRJC’s March 23, 2015 fourth quarter earnings conference call.

- Chinese media reports exposing the detention of JRJC independent director Rongquan Leng prompted JRJC to announce his resignation, without addressing his alleged detention.

- Chinese media reports also indicate serious legal troubles for associates of Zhao, who himself is reportedly not allowed to leave China.

- Ling Wang, a former long-time JRJC director and associate of Zhao, fled China in 2014, leaving his company indebted to JRJC for $25 million.

Serious Legal Troubles Emerge, Undisclosed by JRJC

The first hints of legal trouble at China Finance Online (JRJC) appeared in a December 15, 2014 China’s Tencent Prism magazine special report on the business dealings of the brother of a detained high-level government official. With respect to JRJC, Tencent Prism reported that Ling Wang, a former director of JRJC and close associate of CEO Zhiwei Zhao, fled China in 2014 to escape a corruption investigation. Zhao apparently wasn’t so lucky, as he was reportedly restricted from leaving China at the end of 2014.

In the two trading days following the Tencent Prism report, JRJC shares fell 25%, from $7.62 to $5.70. Disturbingly, JRJC management did not respond to the report, despite the very serious allegations and large decline in the share price.

On March 23, 2015 JRJC reported dismal earnings and its stock fell by 26% from $6.19 to $4.58. Chairman Zhao was mysteriously absent from this important earnings conference call, the first he had missed since July 2013. JRJC provided no explanation for Zhao’s absence, but did provide a quote from Zhao in the earnings release as well as a prepared remark purportedly from Zhao that was read during the conference call.

Matters took another turn for the worse on April 17, 2015, when Caixin Magazine reported the official detention of JRJC independent director Rongquan Leng during a corruption investigation. The article pointed out that Leng’s “…fall might be related to a U.S. listed company.” Also, the article cited a source who claimed that Leng and the brother of the detained high-level government official “participated in the control of the shares of a U.S. listed company from behind the scenes.”

In response the Caixin report, JRJC issued a hastily prepared press release later that day announcing the resignation of Mr. Leng “for personal reason.” Incredibly, JRJC did not comment on any of the issues raised in Caixin’s report. JRJC thus appears to be determined to keep U.S. investors in the dark regarding the company’s numerous legal issues in China.

CEO Zhao Suddenly Resigned from the Management of Three of JRJC’s Key Chinese VIE Subsidiaries

For U.S. investors, JRJC’s legal issues are compounded by the risky VIE structure of its Chinese operations. As many authors have previously noted, VIE structures often entail significant risks, especially when a company’s main Chinese operating subsidiaries are VIEs controlled by a person who is in legal trouble. JRJC historically did a poor job disclosing its VIE structure, which was recently questioned by the SEC resulting in JRJC filing an amended 2013 20-F on April 21, 2015 that added more detailed disclosures and related risks. Despite the additional disclosure, JRJC failed to disclose the resignation of CEO Zhao from key VIE management posts made in the weeks prior to the April 27, 2015 filing of its 2014 20-F.

We obtained and reviewed the SAIC records of JRJC’s Chinese VIE and directly owned operating subsidiaries. To our surprise, updated SAIC records show that CEO Zhao suddenly resigned as director, legal representative, and general manager of three key Chinese VIE subsidiaries over the course of the last few months. JRJC has failed to disclose Zhao’s resignations to investors.

The following are the three key VIE subsidiaries that reported the resignation of Zhao in updated SAIC filings:

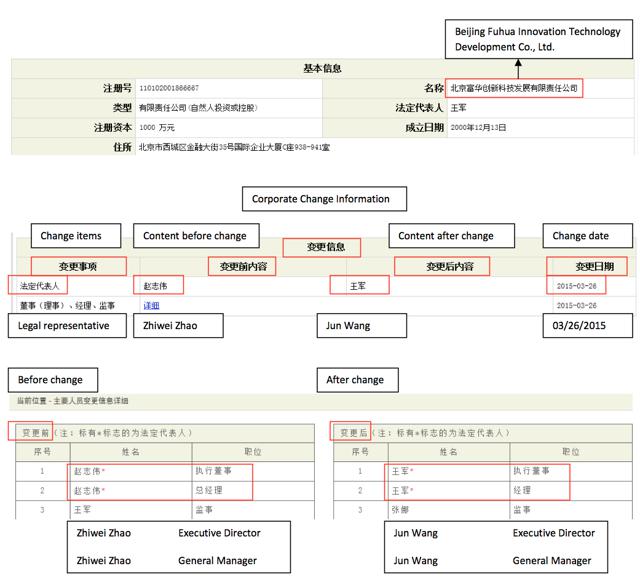

1. Beijing Fuhua Innovation Technology Development Co., Ltd. Beijing Fuhua is the VIE that owns JRJC’s flagship web portal,jrj.com. Chairman Zhao resigned as legal representative, executive director and general manager on March 26, 2015. CFO Jun Wang was appointed as Zhao’s replacement. A translated screenshot of the Beijing online SAIC record:

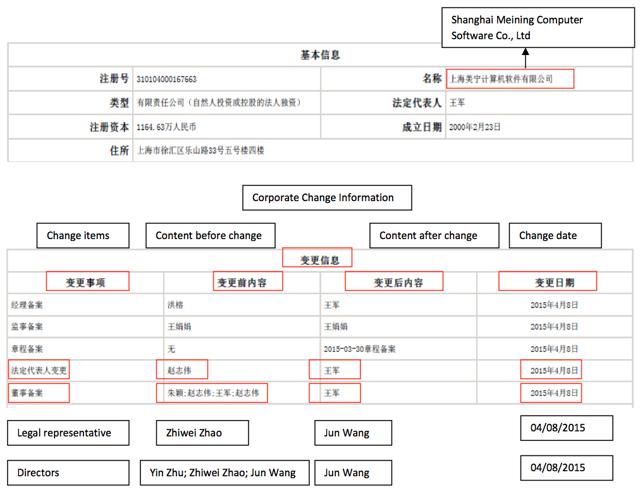

2. Shanghai Meining Computer Software Co., Ltd. Shanghai Meining is the VIE that owns JRJC’s other flagship web portal,stockstar.com. Chairman Zhao resigned as legal representative and director on April 8, 2015. CFO Jun Wang was appointed as Zhao’s replacement. A translated screenshot of the Shanghai online SAIC record appears below:

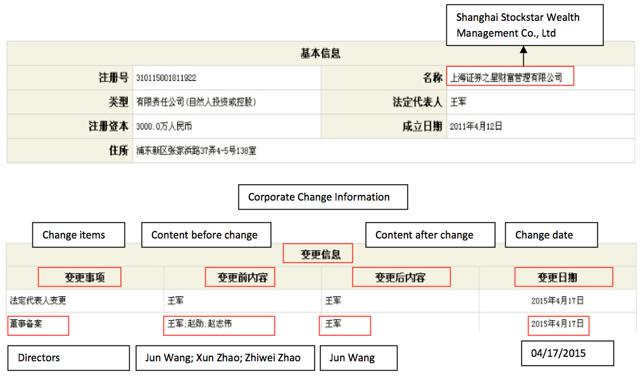

3. Shanghai Stockstar Wealth Management Co., Ltd. Shanghai Stockstar is a VIE that, along with its affiliates, are key to JRJC’s precious metals trading business, which in total contributed 72% of JRJC’s 2014 revenues. Chairman Zhao resigned as a director on April 17, 2015. No replacement was named. A translated screenshot of the Shanghai online SAIC:

One additional subsidiary also reported the resignation of Zhao in updated SAIC filings:

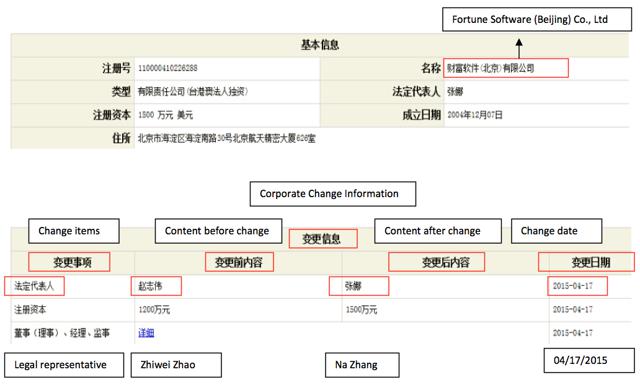

Fortune Software (Beijing) Co., Ltd. Fortune Software has registered capital of $12 million and is 100% owned by JRJC. Chairman Zhao resigned as legal representative, director and general manager on April 17, 2015. A person named Na Zhang was appointed as Zhao’s replacement. A translated screenshot of the Beijing online SAIC record appears below:

After fleeing China in 2014, Ling Wang’s company still owed JRJC $25 million

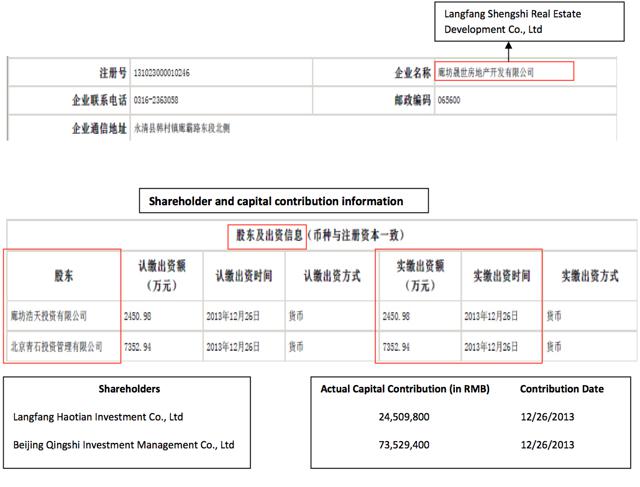

Ling Wang was a former long-time JRJC director and associate of Zhao, who fled China in 2014. Wang resigned from the board of JRJC in 2012. Following Wang’s resignation, JRJC made a questionable real estate investment with Wang’s company, Langfang Shengshi Real Estate Development Co., Ltd., as follows:

“In order to enhance our return on cash during the strategic transition period, in March 2013, we invested an aggregate $22.1 million in a real estate project in Langfang City, Hebei Province, developed by Langfang Shengshi Real Estate Development Co., Ltd. (the “Langfang Developer”).” (page 18 of the 2014 20-F)

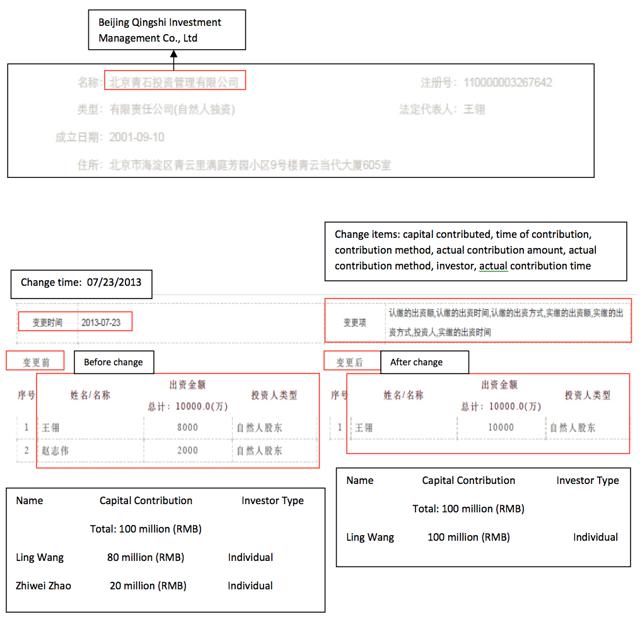

As of December 26, 2013 Langfang Developer was 75% owned by Beijing Qingshi Investment Management Co., Ltd, which was 100% owned by Ling Wang, according to SAIC records shown below:

At the time of this suspicious investment (March 2013), JRJC CEO Zhao also failed to disclose that he had an indirect equity interest in Wang’s Langfang Developer, which according to the SAIC record (above) Zhao transferred to Ling Wang on July 23, 2013.

As of December 31, 2014, Wang’s Langfang Developer owed JRJC $25 million, according to the 20-F, which warns of the risk of failure to collect this outstanding amount (see page 18) but of course never discloses Wang’s predicament with the Chinese authorities. JRJC reported that it received $2.1 million from the Langfang Developer on March 10, 2015 (see page 76 of 20-F).

Implications

It seems that that the Chinese anti-corruption investigation is clearly targeting associates of Zhao (Leng and Wang) and appears to have caused JRJC enough concern that may have led Zhao to take the extreme step of resigning from his management positions in three key VIE subsidiaries.

JRJC repeatedly failed to disclose these highly material events, which in our opinion was part of a plan to intentionally mislead investors by concealing the extent of the Chinese government anti-corruption investigation. Even after being questioned by the SEC regarding the adequacy of its VIE disclosures, JRJC did not disclose the resignation of Zhao in its recently filed 2014 20-F filing, nor did JRJC file any amended legal updates of its VIE structure with the SEC.

We believe it’s fair to assume that the anti-corruption investigation and the removal of Chairman Zhao from the Chinese management will have a material negative impact on JRJC’s business.

Investors may recall that NQ Mobile (NQ) Chairman and Co-CEO Henry Yu Lin was similarly reported to be in legal trouble in China in December 2014. On December 10, 2014, NQ announced Lin had resigned “due to personal reasons unrelated to the Company.” Shares of NQ fell from $6.03 the day before Lin’s resignation to $3.91 at year-end.

We believe that JRJC may perform even worse than NQ without its Chairman and CEO, as the company hasn’t turned a profit in the last three years.

Disclosure: Short JRJC

Disclaimer:

You agree that you shall not republish or redistribute in any medium any information on the GeoInvesting website without our express written authorization. You acknowledge that GeoInvesting is not registered as an exchange, broker-dealer or investment advisor under any federal or state securities laws, and that GeoInvesting has not provided you with any individualized investment advice or information. Nothing in the website should be construed to be an offer or sale of any security. You should consult your financial advisor before making any investment decision or engaging in any securities transaction as investing in any securities mentioned in the website may or may not be suitable to you or for your particular circumstances. GeoInvesting, its affiliates, and the third party information providers providing content to the website may hold short positions, long positions or options in securities mentioned in the website and related documents and otherwise may effect purchase or sale transactions in such securities.

GeoInvesting, its affiliates, and the information providers make no warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the website. All such materials are provided to you on an ‘as is’ basis, without any warranties as to merchantability or fitness neither for a particular purpose or use nor with respect to the results which may be obtained from the use of such materials. GeoInvesting, its affiliates, and the information providers shall have no responsibility or liability for any errors or omissions nor shall they be liable for any damages, whether direct or indirect, special or consequential even if they have been advised of the possibility of such damages. In no event shall the liability of GeoInvesting, any of its affiliates, or the information providers pursuant to any cause of action, whether in contract, tort, or otherwise exceed the fee paid by you for access to such materials in the month in which such cause of action is alleged to have arisen. Furthermore, GeoInvesting shall have no responsibility or liability for delays or failures due to circumstances beyond its control.